If you have ever felt like bill collecting has you doing the tango with your own cash flow, you are not alone. Late invoices, awkward reminders, and endless Excel sheets plague even the hardest working finance teams. Manual invoicing slows you down, ties up resources, and can turn “getting paid” into its own full-time job. Now, picture a system that puts billing on autopilot, transforms follow-ups into friendly nudges, and keeps your revenue moving in the fast lane. Accounts receivable automation makes this a reality. Today, businesses from all sizes unlock more predictable cash flow, fewer errors, and more afternoons spent growing instead of groaning. Let’s look at how modern automation tools can change how you get paid, all while making the whole ordeal a bit less stressful and maybe even enjoyable.

What Accounts Receivable Automation Means for SMBs

Accounts receivable automation means replacing manual, repetitive billing tasks with digital workflows. Instead of entering invoice details by hand, chasing payments, or sorting through email threads, this system keeps data organized, reminders sent, and cash moving in real time. Payments arrive faster, money management becomes predictable, and employees spend their time on work that matters. Automation removes the pain points that make billing the least favorite part of the job for most small and medium businesses.

For businesses that depend on reliable cash coming in, these tools offer freedom from spreadsheet nightmares and the awkward dance of payment reminders. Creating, tracking, and reconciling invoices all flow automatically, making AR automation not just a tool but a complete upgrade to daily business life. The secret sauce? The process stays smooth for both your team and your customers, everyone wins, and your cash flow will finally feel steady.

Main Benefits: More Cash, Less Hassle

The true magic behind accounts receivable automation lies in cash flow. Faster billing means faster payments, without the typical hurdles that slow down traditional collection methods. Automated systems not only send out invoices as soon as a job wraps up, they also schedule personalized payment reminders. This quiet persistence nudges customers to pay on time, freeing staff from those follow-up calls nobody wants to make. No more worrying that cash might not cover this month’s plans.

Processing costs drop as well. Replacing manual entry with smart software means less time spent editing spreadsheets or fixing invoice mistakes. Those hours add up. Staff can focus on high-value work instead of chasing paper or correcting typos. Fewer mistakes also equal fewer disputes, so payments get released without drama or extra waits.

Accuracy gets a huge boost. With an automated workflow capturing, checking, and filing each invoice, the risk of missing zeroes or duplicating records almost vanishes. Every payment, due date, and customer detail is updated instantly. That leads to more trust from clients and more confidence in your own books.

The cherry on top is a better customer experience. Automated billing solutions offer clients a choice in how they pay, clear reminders, and self-service access to old invoices. Everything feels easy, transparent, and secure. Happy customers pay sooner, sometimes just because the process feels less stressful.

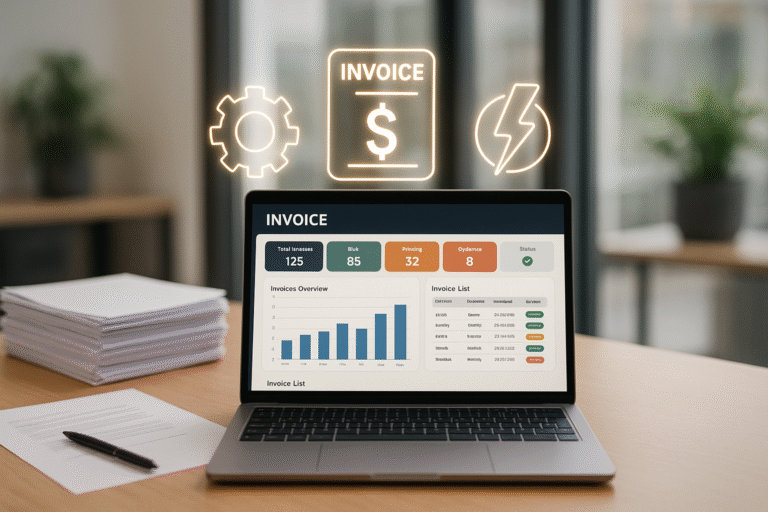

Finally, you get unmatched visibility. Real time reporting shows which clients are behind, which are stars, and which invoices need a quick call. No more guessing about your available cash, no more stacks of unread statements. Decisions get easier.

Cash Flow Acceleration Through Automation

Steady cash flow forms the lifeblood of every business. When payments trickle in slowly, operations stretch thin. AR automation changes this by shrinking the gap from invoice to payment. Quick, accurate invoicing means no delays in sending bills. Automated reminders reduce forgotten payments. Predictable collection times result in better forecasting, freeing owners from the financial limbo that holds growth hostage.

Many businesses find they can shorten the time it takes to collect from customers once automation enters the scene. This shorter cycle gives you the ability to make decisions with more confidence. Extra funds can finally be put toward hiring, product launches, or those long-awaited equipment upgrades rather than sitting in accounts owed.

Cash flow becomes easier to track when you see every invoice’s status at a glance. When reports tell you how much is coming in, who is late, and what patterns are emerging, you no longer need to cross your fingers and hope for the best each month.

Reliable cash flow doesn’t just help pay bills. It helps small and medium businesses dream bigger, without the anxiety of “what if nobody pays on time?” driving decision making.

Lower Costs Without Sacrificing Quality

Traditional AR processes cost time and money, often eating up both at an alarming rate. Manual invoice creation, paper trails, postage fees, and repeated back-and-forth all drive up expenses while delivering less impressive results. One misfiled invoice, or one forgotten follow-up, can mean days or weeks lost to sorting problems out later.

AR automation fixes this by making billing swift, digital, and hands-free. Processing invoices electronically almost always cuts the internal cost per invoice. Once set up, automated systems handle large volumes of invoices for a tiny fraction of the previous expense. Staff can then be reassigned to projects that create growth instead of plugging leaks.

Mistakes go down, not just because software “does the math” better than any human, but because each step checks for missing fields, wrong customer info, or duplicate entries automatically. No more triple-checking numbers each Friday afternoon, no more sheepish phone calls to clients correcting your last mistake.

These cost savings give you real options. Invest in marketing, ramp up inventory, or simply breathe easier knowing you’re not pouring effort into work better fit for a robot than a skilled employee.

Cutting Errors and Building Trust

Manual entry always invites risks. Even the most careful team can skip a line, type a wrong digit, or accidentally leave out that crucial attachment. Over time, these “little” errors can snowball into payment delays, client frustration, and even strained relationships.

Automated AR workflows handle validation and consistency at every step. Each invoice gets generated from accurate customer records, every date aligns with completion timelines, and payment terms never slip through the cracks. The system checks and double checks the details so mistakes rarely make it out the door.

Consistency is everything when building trust, both for your team and your clients. Payment records stay organized, so nobody panics when audit season rolls around. When customers receive invoices that always match their expectations, they pay faster and with less back-and-forth.

Raising the Bar on Customer Experience

No customer enjoys receiving a cryptic bill with a short deadline and little explanation. AR automation flips the script by making invoices look professional every time. Customers get reminders that are polite, timely, and friendly. Rather than surprise emails after something slips through the cracks, clients receive updates that match their expectations.

Offering flexible payment channels – credit card, ACH, or even digital wallets – gives your clients control over how and when they pay. Customer portals allow them to download receipts, review past invoices, or even ask questions without waiting on a callback. This level of transparency turns a painful obligation into a streamlined process.

In many cases, this makes late payments less common since paying on time is now the smoothest path for everyone involved. Businesses that use these systems see more customer satisfaction, with better future relationships as a nice side effect.

Improved Cash Flow Visibility

Staring at a spreadsheet, trying to piece together who owes what, when, and why, can quickly become an exercise in frustration. AR automation presents data in easy-to-read formats, letting you instantly see open invoices, payment trends, and outstanding collections.

Real time dashboards replace endless reconciliations. With just a few clicks, finance teams spot late payers, identify chronic problems, or project next month’s likely cash position. This clarity means smarter decisions, quick action when follow-ups are needed, and solid planning instead of crossed fingers.

Access to meaningful information empowers not just finance departments but owners and decision makers, too.

How to Put AR Automation to Work

Assess which parts of your current accounts receivable process eat up the most time. Many businesses spot trouble in manual data entry, handling exceptions, or chasing down missing information from clients. List your current steps, then circle the bottlenecks or points where errors pop up.

Choose a software tool that matches your needs. Today’s AR automation platforms come in shapes fit for every business, from basic plug-and-play solutions to enterprise-level integrations. The best choice will sync with your accounting and ERP tools, keeping everything connected and avoiding double entry. Don’t forget to check for features such as secure payment portals, customizable reminders, and solid reporting functions.

Once you pick your tool, invest in proper training. Your team needs to know the features, shortcuts, and best practices that will set them up for success. Even the smartest technology needs humans who know how to use it.

Finally, keep reviewing results. Automatic does not mean hands-off forever. Adjust schedules for reminders, edit templates, or add new payment options as your business evolves. Check the data regularly to spot new trends, areas to improve, or sneaky errors that pop up now and then.

Real World Wins: Automation in Action

Think of a small design agency that once relied on sending invoices each Friday, followed by a week of silence and then awkward calls to clients. After switching to AR automation, invoices immediately go out once a project wraps. Payment reminders follow the calendar, not the staff’s mood, and clients appreciate having payment options at their fingertips. Cash comes in quickly, freeing the agency to hire two new designers instead of burning hours chasing payments.

Or picture a wholesale distributor, usually bogged down by the monthly task of reconciling hundreds of payments arriving via wire, check, and credit card. Automation matches payment records to invoices without human help, reducing mismatches and saving the finance team from overtime. The result is a happier team and better service for customers who now trust every payment will be noticed and recorded instantly.

Business professionals everywhere share stories that echo this pattern. Less stress, better results, more time to focus. AR automation is the secret weapon that turns payment delays and missed invoices into ancient history.

Key Features to Look for in AR Automation Tools

To get paid faster, look for an AR automation tool that covers the entire billing lifecycle. The best solutions create invoices from your existing records, validate customer information instantly, and track each bill until payment lands in your account. Built in reminder schedules allow for customized touches that fit your business tone.

Payment portals help customers settle up on their own schedules, reducing the need for back-and-forth and cutting down on late notices. Reporting and analytics let you see performance at a glance, tracking who pays quickly and where to focus future efforts.

Integration with accounting and ERP software is a must. No double entry, no fresh batch of errors. Pick solutions with ironclad security that keep sensitive financial data protected without a second thought. Good automation tools scale as you grow, keeping the billing peace even as your business dreams get louder.

Common Pitfalls to Avoid

Even the most powerful tool falls short if set up poorly. Businesses often underestimate the importance of clear customer records, or neglect to configure reminders for the right intervals. Too many fields or a confusing payment process frustrates clients rather than helps.

Take the time to test new systems before rolling them out company wide. Run a sample batch of invoices, check that templates look correct, and verify that the reminder rhythm feels friendly rather than naggy. If something feels clunky, chances are your customers will think so too.

Train your staff with real world examples, and support them as new habits form. People succeed fastest when they feel comfortable with the change, especially if you show the benefits early.

Future Proofing Your AR Process

Accounts receivable automation continues to develop with smarter AI, mobile-first interfaces, and even more robust analytics entering the field each year. As your business grows, these tools can grow with you, handling larger transaction volumes, more payment routes, and global expansion without the strain that manual processes cause.

Continuous improvement is worth the investment. Whether you stay lean or scale up, the real beauty of automation is never having to go back to the old way. Say goodbye to the fear of unanswered invoices or missed revenue.

Why Now Is the Time to Automate Your AR

With so many accounts receivable automation tools available, this is no longer a luxury for large enterprises. Small and medium businesses see huge returns by automating the billing process, freeing time, cutting costs, and building customer trust. Prompt, reliable payments drive everything else forward. Automate invoices and reminders to get paid faster, unlock time for high-value work, and build a financial process that grows as you do.

The era of manual invoicing has officially run out of excuses.